Rapidly-growing sections of a company may be underfunded, while others are over budgeted until data accumulates and flexible budgets become more accurate at tracking and supporting ongoing trends. The information needed for the preparation of a flexible budget depends on the nature of the budget. For sales forecast, selling price and requirement of sales volume must be known. For cost forecast, various cost information such as direct material cost, direct labor cost, rate of pay, variable expenses and fixed cost is required. For operating an expenses budget, fixed and variable selling, distribution expenses, fixed expenses, variable expenses, general expenses and administrative expenses are required. A budget is a financial plan laid out for a specified period, expressed in terms of money.

- You can also study the monthly adjustments and notes to more accurately plan for future costs.

- It may be favorable (higher than it should have been for actual production activity) or unfavorable (lower than it should have been).

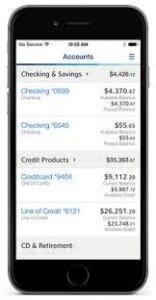

- You can access automated customer, account, and department mapping to ensure your variance reports can get to the most granular level with just a few clicks.

- In short, a flexible budget gives a company a tool for comparing actual to budgeted performance at many levels of activity.

The static budget serves as a mechanism to prevent overspending and match expenses–or outgoing payments–with incoming revenue from sales. In short, a well-managed static budget is a cash flow planning tool for companies. Proper cash flow management helps ensure companies have the cash available in the event a situation arises where cash is needed, such as a breakdown in equipment or additional employees needed for overtime.

Shrink the budget cycle.

Static budgets may be more effective for organizations that have highly predictable sales and costs, and for shorter-term periods. If, however, the cost was identified as a fixed cost, no changes are made in the budgeted amount when the flexible budget is prepared. Differences may occur in fixed expenses, but they are not related to changes in activity within the relevant range. Since the flexible budget restructures itself based on activity levels, it is a good tool for evaluating the performance of managers – the budget should closely align to expectations at any number of activity levels. It is also a useful planning tool for managers, who can use it to model the likely financial results at a variety of different activity levels. Flexible budgets calculate, for example, different levels of expenditure for variable costs.

This was exactly our experience when working with a large multinational mining company during the 2015 commodity price slump. With prices falling more than 50% on a number of metals, its annual budgets became obsolete in a matter of days — but the traditional budget adjustment process was complex, slow, and limited in nuance. Flexible budgets can also be used after an accounting period to evaluate the successful areas and unsuccessful areas of the last period performance. Management carefully compares the budgeted numbers with the actual performance statistics to see where the company improved and where the company needs more improvement.

Of course, if you have the means in the future, you can use both budgets to benefit from their advantages. But I think that for a small business that’s just starting out, a static budget will work. The budget is prepared for each level of activity selected by associating the activity level with corresponding costs.

How to create and implement a flexible budget for your business

Also add the capital expenditures budget and the cash-flow budget to arrive at a budgeted balance sheet. The master budget allows company directors to forecast the actions they will need to take in the upcoming quarter or year to meet their goals. If you own an ice cream shop, you know that the height of your business will be in the warm summer months. Using a flexible budget allows you to account for increased revenues, higher labor costs, and higher inventory costs during the busier months without having to adjust for months when business is slower.

Another way of thinking of a flexible budget is a number of static budgets. For example, a restaurant may serve 100, 150, or 300 customers an evening. If a budget is prepared assuming 100 customers will be served, how will the managers be evaluated if 300 customers are served? Similar scenarios exist with merchandising and manufacturing companies. To effectively evaluate the restaurant’s performance in controlling costs, management must use a budget prepared for the actual level of activity. This does not mean management ignores differences in sales level, or customers eating in a restaurant, because those differences and the management actions that caused them need to be evaluated, too.

Expenses such as rent, management salaries, and marketing costs remain static and do not change based on production. When using a static budget, a company or organization can track where the money what is your strongest asset is being spent, how much revenue is coming in, and help stay on track with its financial goals. With businesses undergoing constant changes, targets and budgets need to become more adaptive.

How do you calculate a flexible budget?

As mentioned before, this model is a much more hands on and time consuming process requiring constant attention and recalibration. NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support. The budget for capital expenditures contains budgetary figures for the large, expensive fixed assets for the business firm. The cash budget states cash inflows and outflows, expected borrowing, and expected investments, usually on a monthly basis. The selling and administrative expense budget deal with non-manufacturing costs such as freight or supplies.

The level of activity in terms of production is required to prepare a budget. Having a few clearly defined and well-calculated lines in the sand gives you a quick and dirty way to move forward while more complex budget re-calculations are performed. Cost per unit, cost per customer acquisition, number of product launches — many different dimensions can be used to set intelligent limits for volatile times.

For example, let’s say a company had a static budget for sales commissions whereby the company’s management allocated $50,000 to pay the sales staff a commission. Regardless of the total sales volume–whether it was $100,000 or $1,000,000–the commissions per employee would be divided by the $50,000 static-budget amount. However, a flexible budget allows managers to assign a percentage of sales in calculating the sales commissions.

Definition and Examples of a Flexible Budget

Fixed costs will be constant within relevant range of operations where the variable costs will continue to increase as production increases. Choosing the appropriate types of budgets for businesses is also dependent on how great the level of variance actually is in terms of increased or decreased profits. This variance is directly affected by the nature of expenses as well, which can be fixed or fluctuating in nature.

Facing Threats, U.S. Navy Struggles to Modernize Its Ships – The New York Times

Facing Threats, U.S. Navy Struggles to Modernize Its Ships.

Posted: Mon, 04 Sep 2023 09:03:15 GMT [source]

Companies develop a budget based on their expectations for their most likely level of sales and expenses. Often, a company can expect that their production and sales volume will vary from budget period to budget period. They can use their various expected levels of production to create a flexible budget that includes these different levels of production. Then, they can modify the flexible budget when they have their actual production volume and compare it to the flexible budget for the same production volume.

Assign responsibility for accountability:

If the factory has to use more machine hours one month, its budget should logically increase. Conversely, if it uses them for fewer hours, its budget should reflect that decline. Learn how it can help your business respond to the ups and downs of the marketplace. For example, if your business predicts that five units will sell per month at $5 each, you can expect a revenue of $25 a month. These points make the flexible budget an appealing model for the advanced budget user. However, before deciding to switch to the flexible budget, consider the following countervailing issues.

adidas Ultrabounce Review (2023) – Sports Illustrated

adidas Ultrabounce Review ( .

Posted: Wed, 06 Sep 2023 14:33:05 GMT [source]

Unlike a static budget, a flexible budget changes or fluctuates with changes in sales, production volumes, or business activity. A flexible budget might be used, for example, if additional raw materials are needed as production volumes increase due to https://online-accounting.net/ seasonality in sales. Also, temporary staff or additional employees needed for overtime during busy times are best budgeted using a flexible budget versus a static one. A flexible budget adjusts based on changes in actual revenue or other activities.

Most flexible budgets use a percentage of projected revenue to account for variable costs rather than assigning a rigid numerical value at the start. A significant downfall to the flexible budget, however, is that it cannot be created until some sales figures have first been generated. This means that a flexible budget is initially based on the performance levels of a past quarter’s static budget. Using a flexible budget for the first time may therefore cause some issues with providing the right amount of resources to meet current needs.